Select Quick Move-in Home Savings

Main Street Homes is offering a 4.99% 30-year fixed conventional rate on select QMI homes.* Offer ends February 28, 2026. Complete this form to connect with Savannah and Daniel, our New Home Specialists. Learn how to personalize your new home savings. See below for details and disclaimers.

Click Here to Explore Special Offers for Quick Move-In Homes.

Click Here to Explore Our Quick Move-In Homes.

Click Here to Explore our Communities.

Click Here to Explore Our Floor Plans.

Click Here to Locate Our Model Home.

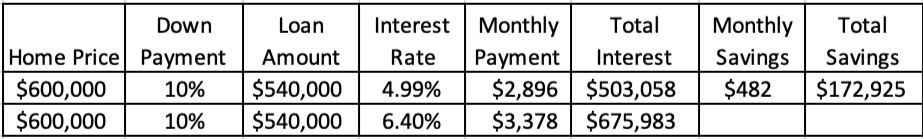

Let’s Do the Math! With a $600,000 Home at 4.99% Fixed for Life.* You Could Save Over $172,000 on Your New Home!*

Estimated payments represent principal and interest only and are based on a conventional loan with a purchase price of $600,000, a 10% down payment, 780 FICO scores, and a 30 Year Fixed Interest Rate of 4.99%! Rates are subject to change daily. This is not a commitment to lend or pre-approval.*

*This special financing offer is available on select single-family homes and townhomes in lieu of flex cash incentives that go under contract between 2/1/26 and 2/28/26 and close within 60 days of agreement ratification. A permanent interest rate buydown from Peoples Mortgage on a fixed-rate conventional loan with a 30-year amortization is available, resulting in an interest rate of 4.99% (APR 5.041%), assuming a 10% down payment for a conventional loan, a 780-credit score, and owner-occupied status with no escrow waiver. Total seller contributions, including those used for buyer rate buy-downs or closing costs, are subject to maximum financing contribution limits imposed by each loan program. These limits may reduce the amount of the incentive that can be applied.

Actual interest rates will vary based on credit score, loan program, down payment percentage, occupancy type, home style, and purchase price. APR’s noted above assume a conventional loan program with a purchase price of $500,000 and 10% down. Rates may change during the loan commitment, lock-in, or closing. Buyers must meet qualifications for specific loan terms, including occupancy, down payment, credit, underwriting requirements, and investor program guidelines. This disclaimer is not an offer to enter into an interest rate or discount point agreement. Any such agreement must be in writing and signed by both the borrower and the lender.

The purchaser is advised to speak with the mortgage providers listed above to determine the exact financing costs required to close.

While the purchaser can use any lender, the promotional closing cost credit is only available with a mortgage loan obtained through Peoples Mortgage. Purchasers are encouraged to shop around to ensure they receive the best services and rates.

Please note that the owner of Main Street Homes is affiliated with MFR2, LLC, which has a business relationship with Tidewater Home Funding (a/k/a Benchmark Mortgage), where MFR2, LLC has a 2.5% ownership interest. This relationship may provide MFR2, LLC with a financial or other benefit.

Main Street Homes reserves the right to change or withdraw any offer at any time.